How To Pay For A New Roof

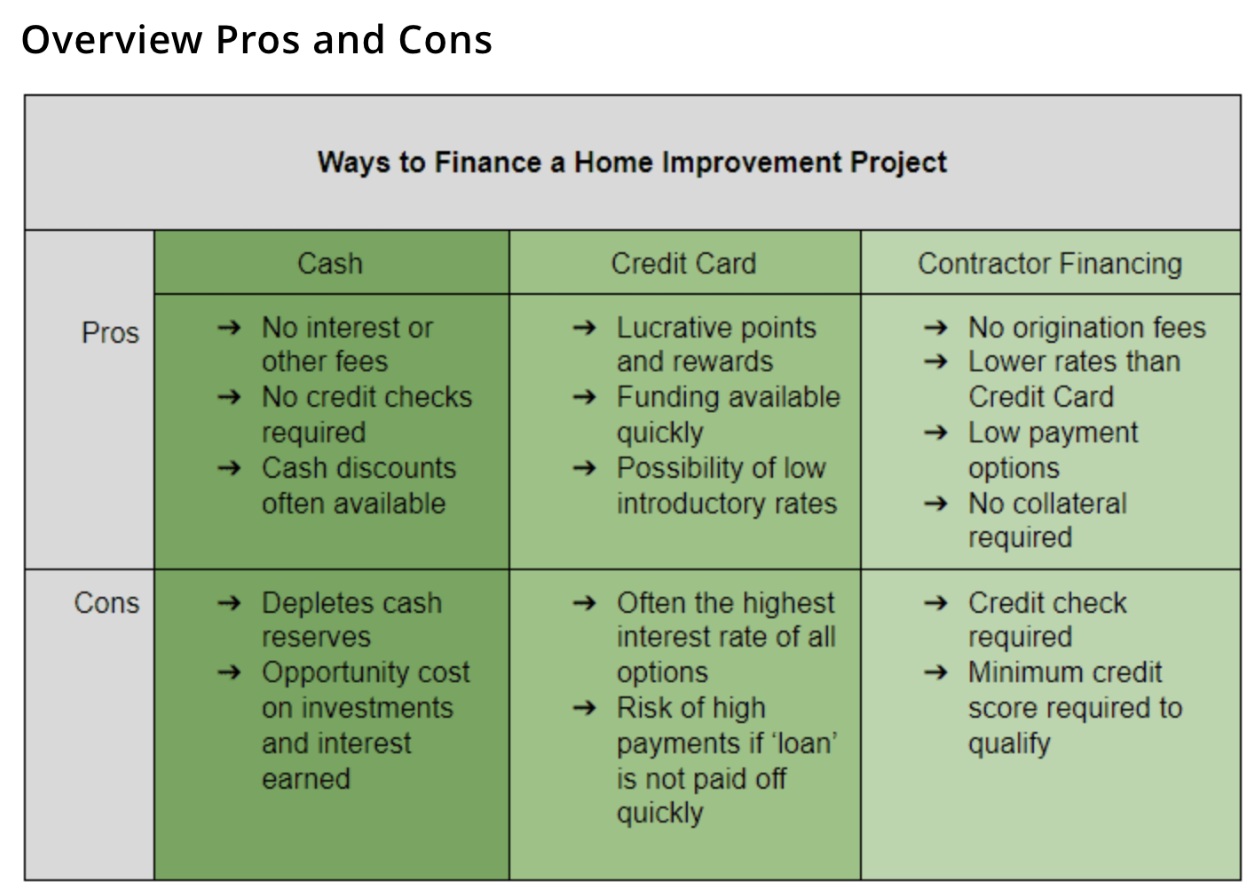

When buying a new roof, homeowners often ask: "How do I pay for this?" Purchasing a new roof can sometimes exceed the initial budget, but working with reputable roofing companies that offer accurate and free roof estimates can provide a solid starting point. Once you have a budget range, you can choose the best roof financing option for your situation. Let's explore three ways that you can pay for a new roof, including financing options.

How To Pay For A New Roof: Paying with Cash

Many financial experts recommend using cash for both large and small home improvement projects, as it doesn't add to existing debt. MarketWatch promotes using cash for home improvement projects because it is “a smart decision to use your savings to avoid monthly payments and interest.” There are no fees associated with cash payments, so “cash is absolutely the cleanest, freest way to pay for your project,”(thespruce.com). Some roofing contractors, like Valentine Roofing, even offer cash discounts for certain projects making them even more affordable.

However, you will want to consider the opportunity cost of using your savings. Compare the interest you could earn from your investments with the interest you'd pay on a loan for the project. If your savings can earn more, exploring other roof financing options might be beneficial.

How To Pay For A New Roof: Using a Credit Card

Credit cards can be a convenient way to finance your new roof, especially if they come with rewards like cashback, miles, or points. Some credit cards offer zero-interest introductory rates for new cards or specific purchases, providing a period to pay off the balance without incurring interest. MarketWatch suggests that "getting a credit card that has a 0% interest introductory period could be the best choice you make for funding your home renovations," as it allows you to make payments without interest for a set time.

However, be cautious of the interest rate once the introductory period ends, as it can become quite high. Carrying a large balance on a credit card can also negatively impact your credit score. Weigh the benefits of rewards against the potential risks before deciding.

How To Pay For A New Roof: Contractor Financing

Many roofing contractors offer in-house financing for roofs, often through partnerships with third-party lenders. These loans are usually unsecured, meaning you don't need to use your home or other assets as collateral. With potentially lower interest rates, these loans often have manageable monthly payments. Another advantage is the typically lower fees compared to personal loans, with no origination fees or early payment penalties.

However, these loans usually require a credit check and a minimum credit score for approval. For qualified buyers, roof contractor financing can be an excellent option to maintain liquidity while enhancing your home's value.

Valentine Roofing Financing Options

Valentine Roofing partners with a local credit union to provide financing options for home improvement projects, such as roof replacements. Our roof financing features:

- Zero down payment, with interest rates as low as 4.99%

- Loan terms up to 10 years, keeping payments low

- No early payment penalties

For more information about our roof financing program, contact Valentine Roofing at (206) 766-3464 today.